The validation of a Chartered Accountant through attestation on a certificate or any similar document holds great significance as it typically indicates that the Chartered Accountant, based on their professional judgment, ensures that the entity submitting or issuing such a document does not make any false statements.

A notable instance of this is an audit report issued by the auditor regarding the financial statements of an entity, affirming that the financial statements accurately represent the state of affairs of the entity. It is due to this attestation or signature provided by the Chartered Accountant that investors and other stakeholders can trust the performance of an entity. The complete form of UDIN is a Unique Document Identification Number.

An Explanation About Unique Document Identification Number (UDIN)

It is an exclusive number allocated through the UDIN portal to each certificate and similar documents that have been validated by a Chartered Accountant registered on the portal.

It has come to notice that some dishonest individuals are falsifying signatures by posing as Chartered Accountants to issue fraudulent certificates and other documents to trick the authorities. Considering this situation, the Institute of Chartered Accountants of India (ICAI) has devised a system to safeguard the documents issued by a Chartered Accountant through the issuance of a Unique Document Identification Number (UDIN). The official announcement can be accessed on the ICAI website.

Read Also: What is a Bookkeeper Services? How Much Bookkeeper Demand?

What is the Process to Register on the UDIN portal?

It is necessary for the full-time practising Chartered Accountants (CAs with COP) to first register themselves on the UDIN portal then they can generate the UDIN for documents to be attested.

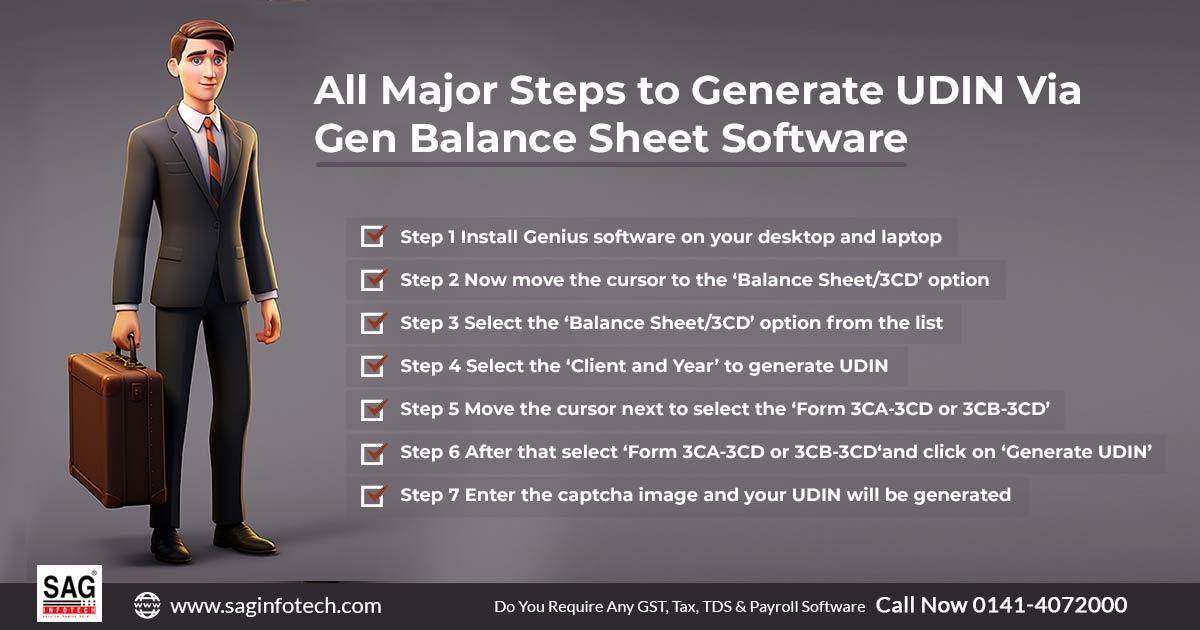

Step-By-Step Guide to Generate UDIN By Gen Bal Software

Step 1: First of all, install the Genius software on your desktop or laptop.

Step 2: Once the software is installed, navigate to the ‘Balance Sheet/3CD’ option.

Step 3: From the available options, choose the ‘Balance Sheet/3CD’ option.

Step 4: Proceed to the next step and select the ‘Client and Year’ for which you wish to generate the UDIN.

Step 5: Next, select the desired form from the ‘Form 3CA-3CD or 3CB-3CD’ list for which you want to generate the UDIN.

Step 6: After selecting the appropriate form, click on the ‘Generate UDIN’ button.

Step 7: Subsequently, you will be redirected to the portal screen where you will need to complete the Captcha image and it will generate the UDIN.

Structure of UDIN

A 15-digit UDIN number would be generated in the following format:

-

The first 6 digits would be the Membership Registration Number of the CA

-

The next 6 digits would be the issuance date of a certificate in DD/MM/YYYY format

-

The last 3 digits would be the serial number of the document as generated by the UDIN portal

Authentication of UDIN

As previously discussed, the UDIN is an initiative implemented by ICAI to address the issue of imposters falsely claiming to be Chartered Accountants and forging signatures on documents to trick authorities.

With the UDIN, authorities such as banks, RBI, Income Tax Department, etc., can verify the authenticity of documents issued by Chartered Accountants. Since the UDIN can only be generated by Chartered Accountants through the dedicated UDIN portal, the validity of an attested document can be verified using its UDIN. The document can also be accessible through the UDIN portal using the Firm Registration Number (FRN), Client Reference Code, Date of Document, etc.

Documents Verification via UDIN

After generating a UDIN for a specific document, its details cannot be changed in any way. However, there may be instances where the document needs some modifications or requires complete cancellation.

In such cases, the UDIN can be revoked by searching for the document on the UDIN portal and selecting the ‘Revoke’ option. It is important to provide a reason for revocation. If the UDIN is searched for in the future, it will still appear on the portal but will be displayed as ‘Revoked’.

Conclusion

SAG Infotech Gen Bal Software offers various salient features of importing trial balances from different accounting software such as Tally and Busy, and it is an efficient tool that saves time. Furthermore, it provides features like creating the income statement, expense statement, and financial statement. If you intend to submit the financial statement, you can explore the option of downloading the Gen balance sheet software for free for a limited time to examine the key features offered by the software.